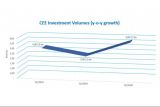

CEE Investment Volumes remain strong in Q1

The preliminary investment volumes for the CEE region for Q1 2020 have reached ca. €3.7 billion, despite the onset of Covid-19 in CEE at the beginning of March. This volume was significantly boosted by the ca. €1.3 billion acquisition of the Residomo portfolio in Czech Republic by Heimstaden and as such represents a y-o-y growth of 68% over Q1 2019 (ca. €2.2 billion) and 28% over Q1 2018 (ca. €2.9 billion).

After a record breaking year in 2019, Poland maintains its leading position in the region with a 48% share of the Q1 volume, followed by Czech Republic with 39%, Slovakia (5%), Romania (4%), Hungary (2%) and Bulgaria (2%).

Kevin Turpin, Regional Director of Research | CEE adds: “Due to the various measures imposed to keep people safe and prevent the spread of the virus, including flights and border restrictions, we expect that the volumes in Q2 and Q3 will be significantly impacted as all parties involved in transaction processes are largely unable to meet or visit properties.”

In addition to these hopefully fairly short term restrictions, many property owners and managers are currently busy assessing and managing any risks to their assets. Individual responses to the pandemic by the region’s Governments have, to date, mainly been focused on addressing salaries of employees and supporting businesses, particularly those most impacted by the restrictive measures. Other than some potential short term tax relief, many property owners may well feel left out when it comes to the protective measures.

According to initial results from an ongoing Colliers survey, investor appetite remains strong, the volume of capital for deployment also remains and could potentially increase, but many investors will hold off on decisions for a number of weeks until the situation becomes clearer, particularly in regard to financing, pricing and the ability to physically view potential opportunities.

Andy Thompson, Head of Investment, Czech and Slovak Republics, Colliers International commented: “Of course, there is a bit of “wait and see” in the markets, but as some of the competition sits still, more optimistic parties on both the buy and the sell-side are taking advantage. We are involved in several investment transactions with both local and international investors in the Czech Republic that are progressing. Business will not stand still for long and the investment and occupier worlds are both already waking up to the fact that Czech, Slovakia and wider CEE have responded very positively to the pandemic. The Czech government for example, has just passed a new directive that regulates loan repayment measures in connection with a pandemic.”

Harry Bannatyne, Partner and Head of Industrial, Colliers International Czech Republic, added: “There could be also opportunities emerging from the crisis. The CEE market could hopefully see more manufacturing near shoring again, returning from at risk countries such as China, North America, Asia to supply Europe. Czech Republic is perfectly situated for this as it is not only very strategically positioned, but it also has a long tradition in industrial manufacturing and innovation and some great engineering skills. This would create a new supply of space needed within the country in the mid to long term.

Also, with more than 400 new e-commerce companies being established within the Czech Republic alone we will see a significant increase in space needed to accommodate this new business. I strongly feel that out of all real estate sectors that Industrial & Logistics will have the most positive outcome compared to other sectors such as Retail, Office and also Residential.”

All of the above outlook is subject to how long the pandemic will continue to impact on our lives, to what extent of damage is caused economically and how all active players can recover and adapt to the changes that will certainly come, or at least remain in the short to mid-term future. After all, whether you are a developer, bank, investor, occupier or advisor, there will be an impact for all.

About Colliers International

Colliers International (NASDAQ, TSX: CIGI) is a leading real estate professional services and investment management company. With operations in 68 countries, our more than 15,000 enterprising professionals work collaboratively to provide expert advice to maximize the value of property for real estate occupiers, owners and investors. For more than 25 years, our experienced leadership, owning approximately 40% of our equity, has delivered compound annual investment returns of almost 20% for shareholders.

In 2019, corporate revenues were more than $3.0 billion ($3.5 billion including affiliates), with $33 billion of assets under management in our investment management segment. Learn more about how we accelerate success at corporate.colliers.com, Twitter @Colliers or LinkedIn.

Source of information

Colliers International Czech Republic and ProfiBusiness.world

Date

April 13, 2020

Translator

Vybrané obory

Bankovnictví a pojišťovnictví

Bezpečnost, zabezpečení a ochrana

Cestovní ruch

Domácnost a domácí potřeby

Doprava, přeprava a logistika

Elektro

Elektronika a domácí spotřebiče

Energetika

Finance, daně a účetnictví

Gastronomie a hotelnictví

Hobby a zahrada

Hračky, hry a zábava

Hutnictví a zpracování železa

Hygiena, drogerie a péče o tělo

Charita a sociální odpovědnost

Chemický průmysl

Instituce

IT a počítače

Kancelář

Květiny a rostliny

Lesnictví a zpracování dřeva

Letecký průmysl

Lodě a lodní průmysl

Nábytek

Nerostné suroviny

Obaly a obalové technologie

Papírenský průmysl

Personalistika a lidské zdroje

Plasty a gumárenský průmysl

Podnikání

Potravinářství a nápoje

PR a marketing

Právo a legislativa

Pro firmy

Reality

Kancelář

Sklo, keramika a porcelán

Sociální služby

Sport, relaxace a volný čas

Stavebnictví, architektura a TZB

Strojírenství

Systémy řízení a certifikace

Telekomunikace a internet

Textil, oděvy a kožedělný průmysl

Tisk a tiskové technologie

Věda a výzkum

Vzdělávání

Zdravotnictví a farmacie

Zemědělství

Zvířata a potřeby pro zvířata

Železniční průmysl

Životní prostředí

Novinky a tipy

Bankovnictví a pojišťovnictví

Bezpečnost, zabezpečení a ochrana

Cestovní ruch

Domácnost a domácí potřeby

Doprava, přeprava a logistika

Elektro

Elektronika a domácí spotřebiče

Energetika

Finance, daně a účetnictví

Gastronomie a hotelnictví

Hobby a zahrada

Hračky, hry a zábava

Hutnictví a zpracování železa

Hygiena, drogerie a péče o tělo

Charita a sociální odpovědnost

Chemický průmysl

Instituce

IT a počítače

Kancelář

Květiny a rostliny

Lesnictví a zpracování dřeva

Letecký průmysl

Lodě a lodní průmysl

Nábytek

Nerostné suroviny

Obaly a obalové technologie

Papírenský průmysl

Personalistika a lidské zdroje

Plasty a gumárenský průmysl

Podnikání

Potravinářství a nápoje

PR a marketing

Právo a legislativa

Pro firmy

Reality

Kancelář

Sklo, keramika a porcelán

Sociální služby

Sport, relaxace a volný čas

Stavebnictví, architektura a TZB

Strojírenství

Systémy řízení a certifikace

Telekomunikace a internet

Textil, oděvy a kožedělný průmysl

Tisk a tiskové technologie

Věda a výzkum

Vzdělávání

Zdravotnictví a farmacie

Zemědělství

Zvířata a potřeby pro zvířata

Železniční průmysl

Životní prostředí